When most people think of preparedness, they imagine stockpiling food, learning survival skills, or setting up off-grid power systems. But in 2025, one of the biggest threats Canadians face isn’t necessarily a grid-down scenario — it’s economic instability. Inflation, soaring housing costs, rising food prices, and supply chain disruptions have forced many families to rethink how they prepare. In fact, financial preparedness is becoming just as important as water filters and bug-out bags.

The Rising Cost of Survival

Over the past few years, Canadians have watched grocery bills climb at record rates. Everyday staples like bread, milk, and fresh produce have seen double-digit percentage increases. Energy prices — from home heating to fuel for vehicles — remain volatile, with rural Canadians hit especially hard. For many, the “emergency” is already here: every paycheque buys less, and long-term financial security feels out of reach.

For preppers, this reality demands a shift in mindset. Instead of just preparing for hypothetical disasters, we must prepare for the slow burn crises already impacting our wallets.

Stockpiling as a Hedge Against Inflation

One of the most practical ways to fight inflation is the same principle preppers have used for years: buy it now, while it’s cheaper.

- Bulk Buying: Staple foods such as rice, beans, oats, flour, and pasta can be purchased in large quantities and stored long-term. Prices will almost certainly rise in the future, so stocking now locks in today’s cost.

- Rotating Pantries: Building a working pantry ensures you’re always eating what you store, avoiding waste while keeping shelves stocked.

- Household Essentials: Toilet paper, cleaning supplies, soap, and hygiene products are excellent hedge items. Unlike speculative investments, these items are guaranteed to be useful.

Diversifying Income and Assets

Relying on a single income stream or banking only on cash savings leaves you vulnerable. Preppers today are expanding resilience into the financial realm:

- Side Hustles: Skills like carpentry, gardening, food preservation, and even tutoring can be turned into small income streams or barter opportunities.

- Precious Metals & Tangibles: Silver coins, gold, or even barter goods like alcohol and ammunition have historically held value when paper currency struggled.

- Debt Reduction: Paying down high-interest debt acts as “preparedness insurance.” Once debt is gone, you free up resources to stockpile and invest in resilience.

Growing Your Own Food

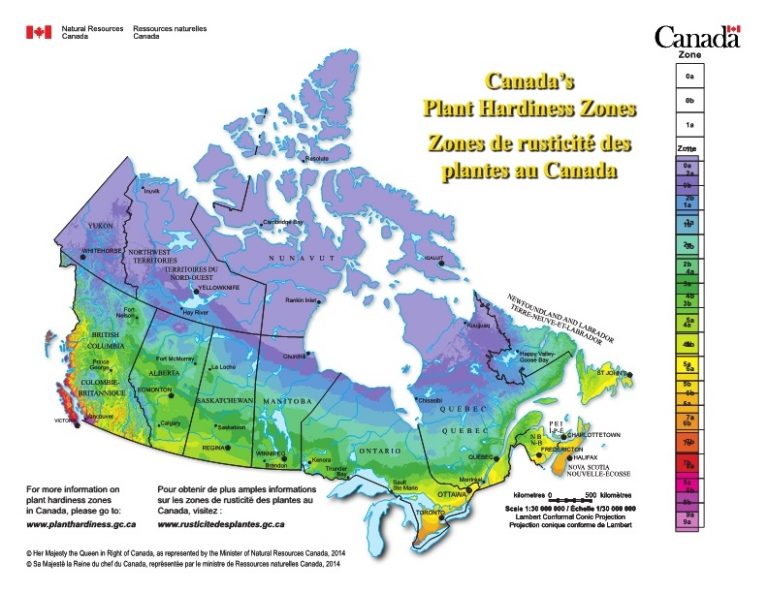

Few things shield a household from inflation better than a backyard garden. Every tomato grown is one less you have to buy at inflated prices. Canadian preppers are increasingly turning to:

- Raised Beds & Greenhouses to extend short growing seasons.

- Seed Saving for long-term self-reliance.

- Small Livestock (chickens, rabbits, ducks) for protein and barter.

The key isn’t just growing food, but learning how to preserve it through canning, dehydrating, or cold storage to build food security year-round.

Building a Financially Resilient Community

Prepping has always been about community, and economic instability is no exception. Barter groups, community gardens, and skill-sharing networks are popping up across Canada. Imagine a neighbourhood where one family grows potatoes, another raises chickens, and a third repairs small engines. Together, the group weathers inflation far better than individuals struggling alone.

Mental Resilience During Financial Stress

It’s not just wallets that suffer during economic hardship — mental health does too. Anxiety, depression, and family conflict often follow financial stress. That’s why preppers must also prepare emotionally:

- Practice budgeting discipline: turn frugality into a survival skill.

- Keep a preparedness mindset: instead of fear, view each financial challenge as training for harder times.

- Focus on practical wins: every jar canned, every bill paid off, every side skill learned is progress.

Final Thoughts

Economic instability isn’t as dramatic as a Hollywood disaster, but it can be just as devastating if left unprepared for. Inflation slowly erodes purchasing power, making daily life a survival challenge in itself. But by stockpiling wisely, diversifying income, reducing debt, producing food, and leaning on community, preppers can not only survive economic upheaval — they can thrive.

Preparedness isn’t just about enduring the worst; it’s about building resilience for everyday challenges. And in today’s Canada, economic resilience may be the single most practical prep of all.